Understanding Your Credit Score

Your credit score is a numerical representation of your creditworthiness, and it plays a crucial role when applying for a loan in the United States. Typically ranging from 300 to 850, this score is a reflection of your credit history, current credit usage, and other financial behaviors. The higher your credit score, the more favorable you appear to potential lenders.

Credit scores are calculated using various factors, the most significant being your payment history, which accounts for 35% of the score. On-time payments positively impact this component, while late payments, defaults, and bankruptcies can have adverse effects. The amount of debt you owe is another critical factor, making up 30% of the calculation. Lenders look at your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. Keeping this ratio below 30% is generally recommended.

Other elements that influence your credit score include the length of your credit history (15%), new credit inquiries (10%), and the diversity of your credit portfolio (10%). A longer credit history and a varied mix of credit types, such as credit cards, mortgages, and personal loans, can positively impact your score.

Lenders consider your credit score as a critical factor because it helps them assess the risk of lending to you. A high credit score indicates that you are likely to repay the loan responsibly, making you a lower-risk borrower. Conversely, a low credit score may suggest higher risk, potentially resulting in higher interest rates or loan denial.

To check your credit score, you can obtain a free credit report annually from each of the three major credit bureaus—Equifax, Experian, and TransUnion—via AnnualCreditReport.com. Additionally, many financial institutions and credit card companies offer free credit score monitoring services.

If your credit score needs improvement before applying for a loan, consider strategies such as paying bills on time, reducing outstanding debt, and avoiding new credit inquiries. Regularly reviewing your credit report for errors and disputing inaccuracies can also help boost your score. By understanding and actively managing your credit score, you enhance your chances of securing a loan with favorable terms.

Exploring Different Types of Loans

In the United States, there are several types of loans available to suit various financial needs. Understanding the different types can help borrowers determine which loan best aligns with their specific circumstances and goals.

Personal Loans: Personal loans are versatile and can be used for a wide range of purposes, such as debt consolidation, home improvements, or unexpected expenses. These loans are typically unsecured, meaning they do not require collateral. Interest rates for personal loans vary based on creditworthiness, ranging from 5% to 36%. Loan terms generally span from one to seven years. To qualify, borrowers usually need a steady income and a good credit score.

Mortgage Loans: Mortgage loans are designed for purchasing or refinancing homes. These loans are secured by the property being purchased. Common types of mortgage loans include fixed-rate mortgages, adjustable-rate mortgages (ARMs), and government-insured loans like FHA, VA, and USDA loans. Interest rates and terms vary, with fixed-rate mortgages offering stability over 15 to 30 years, while ARMs have variable rates that can change periodically. Eligibility criteria include a decent credit score, proof of income, and a down payment.

Auto Loans: Auto loans are specifically for purchasing vehicles. These loans are secured by the vehicle itself, which means the lender can repossess the car if the borrower defaults. Interest rates for auto loans depend on factors such as credit score, the loan term, and whether the car is new or used. Typical loan terms range from three to seven years. To qualify, borrowers need a good credit history, proof of income, and sometimes a down payment.

Student Loans: Student loans help cover the cost of higher education. They can be federal or private. Federal student loans often have lower interest rates and offer more flexible repayment options compared to private loans. Federal loans might include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans. Eligibility for federal loans is determined by financial need and enrollment status, whereas private loans depend on creditworthiness and may require a co-signer.

By understanding the various types of loans available, individuals can make informed decisions about which loan product is most appropriate for their financial needs and situations.

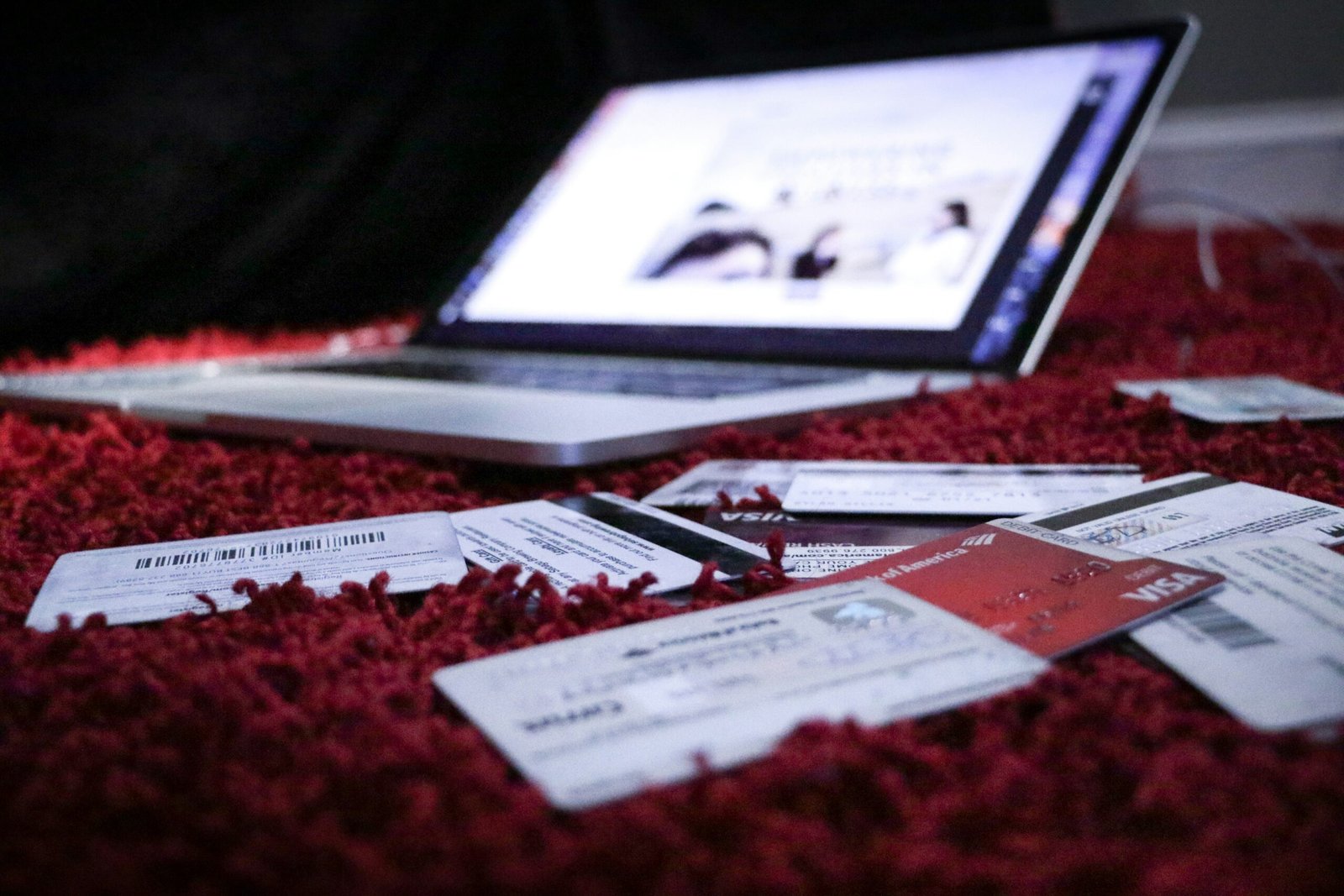

Gathering Necessary Documentation

When applying for a loan in the United States, having the appropriate documentation ready is crucial for a smooth and efficient process. Lenders require specific documents to verify your identity, financial status, and ability to repay the loan. Below is a detailed list of the necessary documentation typically required:

Proof of Income: Lenders need to confirm that you have a steady income to repay the loan. This can be demonstrated through recent pay stubs, W-2 forms, or if you are self-employed, a profit and loss statement or 1099 forms.

Employment Verification: In addition to proof of income, lenders often require verification of your current employment status. This can be a letter from your employer or recent employment contracts.

Tax Returns: Providing your tax returns for the past two years helps lenders understand your financial history and stability. It is especially important for self-employed individuals or those with unconventional sources of income.

Bank Statements: Lenders typically ask for your bank statements from the past three to six months to assess your cash flow and savings. This helps them determine your ability to manage and repay the loan.

Identification: Valid government-issued identification, such as a driver’s license, passport, or state ID, is required to verify your identity.

Additional Documentation: Depending on the type of loan and the lender’s requirements, you may also need to provide documents such as a lease agreement or mortgage statement, utility bills, or proof of other assets like investments or property.

To streamline the loan application process, organize all your documents in advance. Ensure that each document is up-to-date and accessible, either in physical form or digital copies. Create a checklist to ensure you have gathered all necessary documents before submitting your application. Proper organization and timely submission of these documents can significantly expedite the loan approval process, making it easier for you to secure the loan you need.

Comparing Lenders and Loan Offers

When seeking a loan in the United States, one of the most critical steps is comparing lenders and their respective loan offers. This process ensures that you secure the best deal tailored to your financial situation and needs. Shopping around and evaluating different lenders can save you considerable amounts of money and time over the life of the loan.

When comparing loan offers, pay close attention to the interest rates. The interest rate significantly impacts the total cost of the loan; thus, it’s imperative to find the lowest rate available. Additionally, consider the fees associated with the loan, such as origination fees, processing fees, and prepayment penalties. These fees can add up quickly and affect the overall affordability of the loan.

Repayment terms are another crucial aspect to evaluate. Look at the length of the repayment period and the flexibility of the repayment schedule. Longer repayment periods might result in lower monthly payments but could increase the total interest paid over time. Conversely, shorter repayment terms often mean higher monthly payments but less interest overall. Ensure the repayment terms align with your financial capabilities and long-term goals.

Customer service quality should not be overlooked. A lender with excellent customer service can provide valuable support throughout the loan process and beyond. Reading customer reviews and testimonials can offer insights into the lender’s reliability and customer satisfaction levels. Reputable lenders will generally have positive feedback and a track record of addressing customer concerns promptly.

Utilizing online comparison tools can streamline the process of evaluating different lenders. These tools allow you to input your loan requirements and receive offers from multiple lenders, making it easier to compare interest rates, fees, and terms side by side. Additionally, online platforms often include customer reviews, giving you a comprehensive view of each lender’s strengths and weaknesses.

Choosing a reputable lender is paramount to avoid potential pitfalls such as hidden fees, unfavorable terms, or poor customer service. Taking the time to compare different lenders and loan offers thoroughly will ensure that you make a well-informed decision, ultimately leading to a more manageable and cost-effective loan experience.

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective and engaging style set you apart from the crowd. Thank you for sharing your talents with us.